The Market of Insights Into Sleep

Making sense of the market for tracking, monitoring, and diagnosing sleep.

Introduction

Legend has it that the field of modern medical diagnostics began in a wine cellar in Austria. In 1761, Leopold Auenbrugger, a physician working at the Spanish Military Hospital of Vienna, was exploring the possibility of performing an in vivo autopsy, searching for a way to discover the location of internal disease during the life of the patient as opposed to postmortem examination. Auenbrugger was the son of an innkeeper and during a trip to his family’s inn he observed his father tapping on wine casks to determine the amount of wine present. Utilizing the same technique on his patients back at the hospital, Auenbrugger discovered that he could correlate thoracic diseases with the sounds produced by a patient’s thorax when tapped. Auenbrugger had discovered percussion as a diagnostic technique and more importantly, had identified a method to diagnose the location of a disease in a living patient. Today, percussion - along with inspection, palpation, and auscultation - is one of the four actions that form the basis of a physical examination.

Physical examinations offer insights into a patient’s health that can be used to diagnose disease and inform treatment decisions. They give clinicians the opportunity to look for a problem (inspection), listen for a problem (auscultation and percussion), and feel for a problem (palpation). Before the advent of modern diagnostic technologies, clinicians would also taste and smell for problems, sampling patient’s urine to taste for diabetes and smelling sores for signs of infection. These actions enable doctors to perceive if a problem exists, where a problem exists, and to what extent a problem exists. Without these examinations, provisioning healthcare would be guesswork.

In the 250 years since Auenbrugger, the medical technology industry has invented a range of diagnostic technologies to supercharge physicians’ own faculties, from stethoscopes for intensifying sounds to MRIs for seeing under the skin. Modern diagnostic technologies, like blood panels and genetic tests, offer entirely new abilities altogether, enabling clinicians to gather diagnostic insights that are imperceptible to human senses.

At Supermoon, we believe the field of sleep medicine has benefitted more from the advancements in medical diagnostic than any other field. A highly complex physiological process, sleep involves unique changes to brain activity, eye movements, heart rate, muscle activity, and body temperature. These processes occur under the cover of darkness when a patient is unconscious, at home, and often alone. Traditional physical examinations are thus of little value in perceiving the symptoms associated with unhealthy sleep and are an insufficient means of diagnosing sleep disorders.

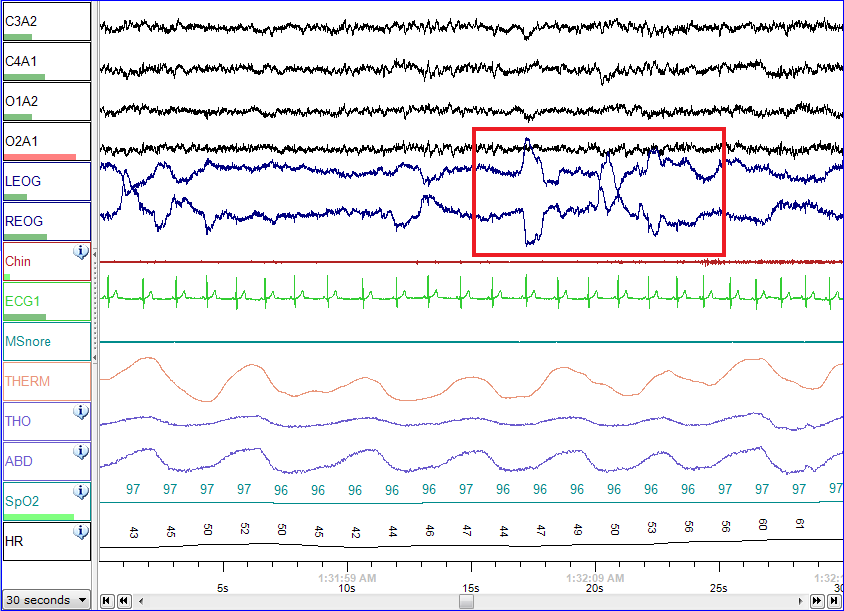

Fortunately, a range of technologies invented over the last 75 years have opened a window into the once-obscured realm of sleep and now provide crucial insights into the pathophysiology of sleep disorders. From the electroencephalogram (EEG) to the electrocardiogram (ECG) and the photoplethysmogram (PPG) to sonar sensors, contemporary medical sensing technologies are enabling sleep doctors to perceive if a sleep disorder exists, where a sleep disorder exists, and to what extent a sleep disorder exists.

As these technologies transcend the lab and move from bench to bedside, patients themselves are able to visualize and measure the quantity and quality of their sleep through wearable devices, “nearable” devices, and consumer EEG technologies. These devices enable individuals to track their personal sleep data longitudinally, affording the possibility of perceiving changes over time, recognizing undesirable trends, and incentivizing action toward better health.

What were once barriers to the diagnosis of sleep disorders are now benefits. The sleeping patient, unconscious and stationary for hours in a consistent, low stimulus environment, presents a uniquely valuable window of opportunity for physiological data collection. Sleep is the best time across the 24 hour cycle to capture large quantities of high fidelity physiological data; environmental noise is reduced, wired power generation can be utilized, and subjects are less likely to interfere with the recording device. Perhaps most importantly, an incredibly large amount of data can be captured. A standard sleep study captures data from four to six EEG channels, two EOG channels (eye movement), and one EMG channel (muscle activity), plus a range of simultaneously recorded cardiac and respiratory signals like pulse rate and blood oxygenation. Each of these sensors captures upward of 200 datapoints per second, collectively generating thousands of physiological datapoints per second and millions of datapoints throughout the course of the night. The quantity and comprehensive nature of this data is uniquely suited for machine learning algorithms capable of perceiving diagnostic insights imperceptible to human senses. Thus, sleep’s singular characteristics may ultimately position the field to benefit the most from advancements in diagnostic technology, from physiological sensors to AI software.

Bounding the Market

At Supermoon, we segment the sleep market spectrum into three broad categories: interventions - ways and means to treat, improve, and enhance sleep; insights - ways and means to track, monitor, and diagnose sleep; and infrastructure - ways and means to streamline, optimize, and enable sleep market businesses.

This grouping structure is not mutually exclusive, but it is, for the most part, collectively exhaustive. Many companies in the market offer products across segments, but we can generally always bucket a startup into at least one of these segments.

This profile focuses on the insights category of the sleep market spectrum. It is not meant to be comprehensive (there are hundreds of startups in the sleep insights market), but it should instead help provide an overview of the incumbents and startups building solutions to track, monitor, and diagnose sleep. You can find my previous profile on the sleep interventions market here.

Categories of Insights

At Supermoon, we segment the sleep insights market into four categories: trackers, diagnostics, tests, and supplies. At a high-level:

Trackers help us monitor physiological, behavioral, and environmental variables over time.

Diagnostics help sleep providers classify and measure health conditions along industry-established guidelines.

Tests help us identify biomarkers of disease and provide a lens into our genes, hormones, and neurological health.

Supplies furnish sleep providers with the hardware to collect information on our nocturnal health.

The vast majority of companies in the trackers category and the tests category sell B2C (with the exception of some companies in the fatigue, actigraphs, and intraoral segments), while the vast majority of companies in the diagnostics category and the supplies category sell B2B.

Market Evolutions

Everyone wants a piece of the home sleep test market: Covid flipped the switch for home sleep testing. Before the pandemic, about 70% of sleep tests were in-lab polysomnograms and only 30% of sleep tests were performed at-home. Today, the ratio is inverted: 70% of sleep tests are done at home and only 30% are performed in the lab. Recognizing the shifting landscape, incumbents ResMed and Zoll both acquired HST device manufacturers in 2021 (Ectosense by ResMed, Itamar Medical by Zoll). Startups like Onera, Acurable, and Wesper are all innovating around product design but offer sleep providers different “types” of HSTs, with some tests more comprehensive than others.

Harnessing the power of smartphones: In 2018, SleepScore Labs launched the first non-contact sleep tracking app, which transformed a user’s smartphone microphone into a sonar-based sensing technology. Instead of having to purchase a new hardware device, consumers could simply download an app onto their smartphone and begin tracking their sleep that night. Following SleepScore’s lead, startups like Apneal, Diametos, and SnoreLab are developing apps to track sleep, screen for sleep apnea, and diagnose snoring. Last year Pfizer acquired ResApp Health, which identifies respiratory disorders like sleep apnea by analyzing users’ coughs.

Connecting the dots between sleep and disease: The Digital Medicine Society publishes an open-source library of industry-sponsored studies of new medical products that utilize digitally-collected endpoints. Almost 30% of all records in the database are related to sleep. From using wake after sleep onset (WASO) to test the efficacy of a biologic for glucose intolerance to using sleep onset latency to test the efficacy of a drug for adrenal insufficiency, pharmaceutical companies and device manufacturers are recognizing both the value of physiological monitors to their R&D and the value of sleep related metrics as clinical endpoints.

Wearables as jewelry: Wearables are a form of social signaling, indicating to others that the wearer attends to their personal health and wellness and placing them among the ranks of other wearers of wearables like professional athletes and business executives. These devices become a part of an individual’s style and take real estate from rings, bracelets, and luxury watches. Incumbents like Apple and Oura have promoted this concept through partnerships with luxury icons Hermès and Gucci, while Whoop has pushed the customization potential of their wearable with a wide variety of straps.

Cautionary Tales

Differentiation in the B2B sleep test market is increasingly difficult: As incumbents and startups alike tap into the shift to home sleep testing and offer sleep providers cheaper, smaller, and sleeker hardware devices, capturing market share becomes increasingly difficult. Incumbents with economies of scale, global distribution, and large sales departments have significant competitive advantages. Startups in this category will need to differentiate their hardware devices with software offerings that improve provider efficiency and reduce provider costs. New entrants may also find success targeting customer cohorts that have been historically overlooked or underpenetrated by incumbents, such as dental practices and cardiologists.

Insights without interventions aren’t sticky: Much has been said about the overload of information provided by consumer tracking devices. In fact, some users actually end up developing insomnia by obsessively concerning themselves with the data gathered by such devices, a condition known as “orthosomnia”. Yet for the majority of consumers, devices that simply provide sleep insights without offering interventions quickly lose their appeal. Successful startups in this category will pair their insights with interventions, either through development of in-house interventions (sleep coaching, soundscapes, product recommendations, etc.) or by partnering with other businesses across the sleep care continuum. Founders should thoughtfully consider opportunities to quickly prove value to customers, as many users are likely to churn before value from longitudinal data insights can be recognized.

On the Horizon

To diagnose is to detect a deviation from the norm. For Auenbrugger, to diagnose was to hear a diseased thorax produce a different sound than a healthy thorax. But for the sleep industry today, the very nature of sleep diagnostics is in flux.

Who gets to diagnose? As dentists, GPs, and other specialists increasingly recognize the relationship between sleep and their own respective medical fields, they increasingly seek opportunities to involve themselves in the nocturnal lives of their patients. Should they be authorized to diagnose sleep disorders? As patients increasingly gather data and insights into their own sleep, they are increasingly empowered with the technology to detect deviations from the norm. Should they be empowered to seek out low-risk interventions like CPAPs without a prescription? As machine learning algorithms increasingly demonstrate the ability to score sleep studies faster, cheaper, and more consistently than registered polysomnographic technicians, they increasingly assume greater and greater responsibilities across the sleep care continuum. Should they be sanctioned to make definitive diagnoses without human sign off?

How is a deviation detected? As polysomnograms increasingly lose their once-held monopoly on sleep disorder diagnostics to a range of home sleep test types, the lines between medical device and consumer gadget become increasingly blurred. Should consumer wearable devices be legitimized as clinical diagnostic technologies?

When can a deviation be asserted? As the opportunity to longitudinally track sleep over many nights, months, and years becomes increasingly technologically and commercially viable, the traditional one or two night sleep study looks increasingly archaic. Should a single night of sleep determine a patient’s eligibility for a potentially life saving intervention?

What constitutes the norm? As sleep scientists increasingly learn more about the mysteries of sleep and the etiologies of sleep disorders, their research increasingly suggests a wide spectrum of individual sleep needs, patterns, styles, and benchmarks. Should the sleep community reconsider standardized definitions like “healthy” sleep quantity (7-9 hours) and “moderate” sleep apnea (15 to 30 events per hour)?

Opportunities to create value in the sleep insights market will appear while others disappear as these questions get answered over the coming years.

Stay tuned for my next sleep market profile covering the infrastructure category: companies developing solutions to streamline, optimize, and enable sleep market businesses.

Access the full list of companies featured in this profile here.

Did I miss a company? Submit companies you think should be added to the profile here.

Supermoon is the only venture capital firm in the world focused exclusively on the sleep technology and healthcare market. If you’re building in the sleep insights market or interested in partnering with one of our portfolio companies, I’d love to chat. You can reach me on LinkedIn and Twitter, or email me directly at gj@supermooncapital.com.

Very cool overview of this market. I'd be curious to hear what your sleep "tech stack" looks like after having evaluated so many of these emerging technologies

Interesting piece. Loved the arch regarding an important part of medical diagnostics. Found the next question a great challenger. It is pretty much rhetorical: "Should a single night of sleep determine a patient’s eligibility for a potentially life saving intervention? "

After reading the very eloquent piece I find myself absolutely sure sleep diagnostics will be done at homes and provide a very good and necessary pre- medical stamp that will be as common as pregnancy test and maybe even personal thermometers. Looking forward to the next infrastructure chapter.

Great text.